Pay for Services Online

Payments are securely processed.

You can pay for your tax prep or consulting services securely using PayPal. Please include your name or invoice number in the payment notes. You’ll receive a digital receipt by email within 24 hours.

Simple tax services

Affordable plans for every filer

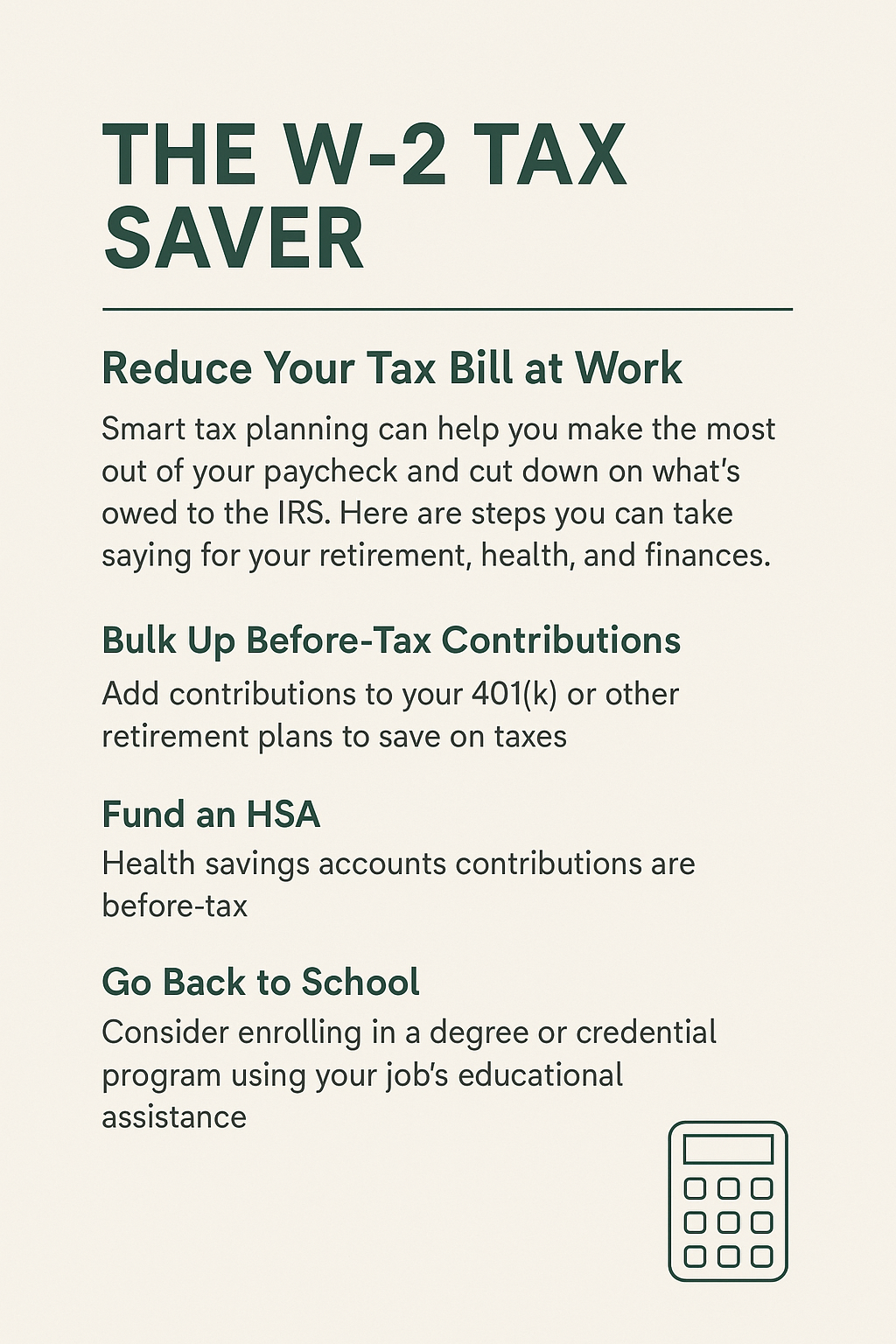

W-2 tax saver guide

A clear, step-by-step guide for W-2 employees to maximize deductions and file confidently.

The W-2 Tax Saver Guide is your essential companion for navigating tax season with confidence. Designed specifically for W-2 employees, this guide breaks down complex tax concepts into straightforward, actionable steps. It includes tips on maximizing deductions, understanding tax credits, and avoiding common filing mistakes. Whether you're filing independently or preparing to meet with a tax professional, this guide empowers you to keep more of your hard-earned money. Clear, concise, and packed with valuable insights, the W-2 Tax Saver Guide takes the stress out of filing and helps you achieve a smarter tax outcome.

$39

Write It Off Right

An essential resource for freelancers to organize income and claim deductions effortlessly.

1099 Made Easy simplifies the tax filing process for freelancers, contractors, and gig workers who receive 1099 forms. This comprehensive resource guides you through organizing income, tracking expenses, and understanding deductible costs unique to independent work. It offers practical advice on record keeping and tax law changes that impact freelancers. With easy-to-follow instructions and helpful templates, 1099 Made Easy empowers you to file accurately and on time, reducing stress and maximizing your refund potential.

$39

Tax smart toolkit

A comprehensive digital toolkit with templates and checklists to simplify tax prep for all filers.

The Tax Smart Toolkit is a powerful digital package designed to streamline your tax preparation process. It includes customizable templates, checklists, and budgeting tools tailored for both W-2 employees and 1099 freelancers. This toolkit helps you track expenses, organize receipts, and plan for tax season with ease. Whether you’re juggling multiple income streams or filing for the first time, the Tax Smart Toolkit provides clear, user-friendly resources that save time and reduce errors, helping you keep more of your earnings while staying compliant.

$25

Get your tax help today

Expert support just a click away